Why and how to integrate a mobile wallet into your strategy?

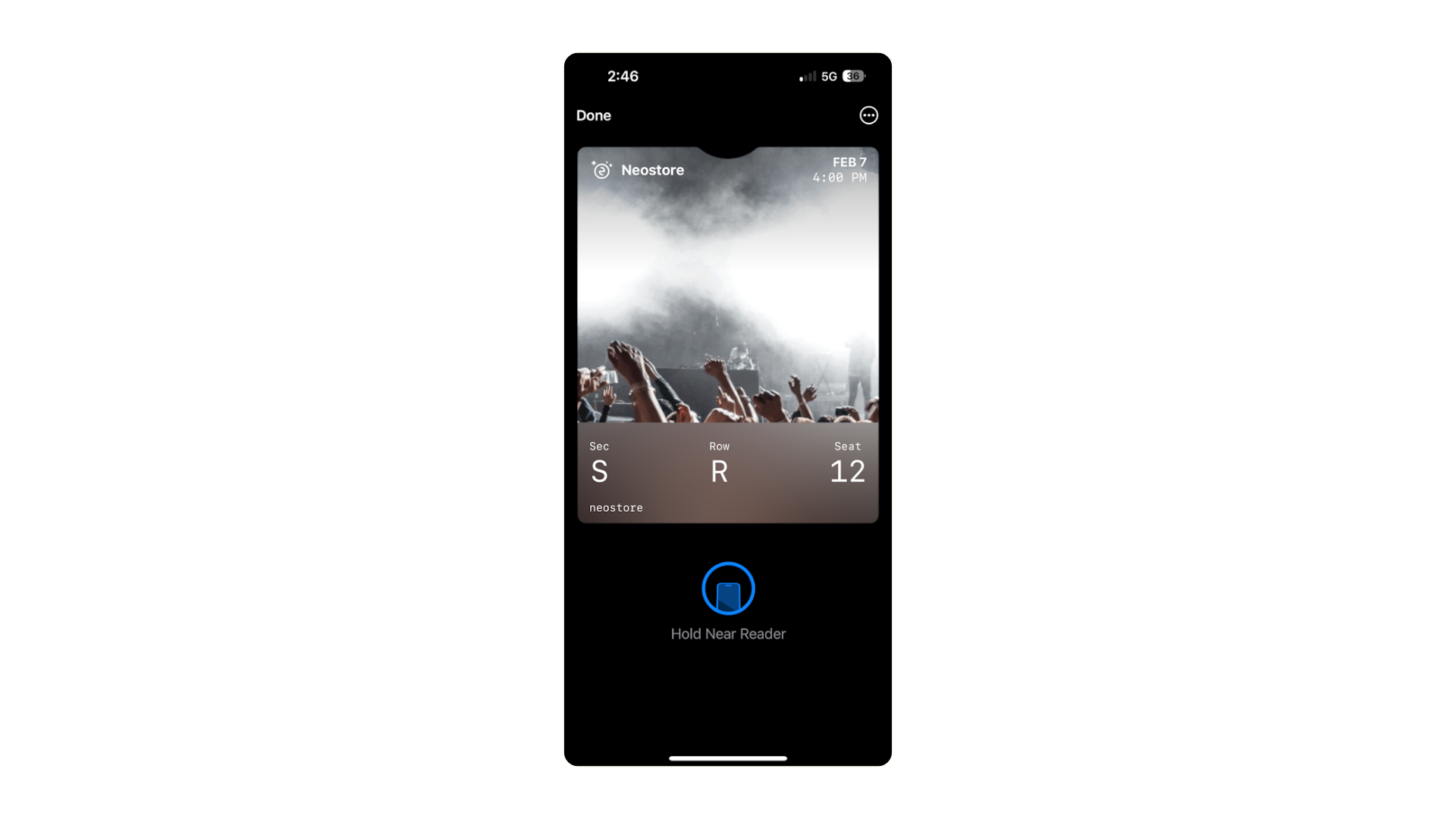

Mobile Wallets have become a strategic tool for digitizing loyalty cards, membership cards, event tickets, and gift vouchers. Thanks to Apple Wallet and Google Wallet, consumers can store and use these assets directly from their smartphones, making their shopping experience and access to physical services more seamless.

In this guide, we share best practices for selecting and implementing a Mobile Wallet solution that is efficient and tailored to your organization.

Different approaches to implementing a mobile wallet in your strategy

When it comes to integrating a Mobile Wallet solution, several approaches exist.

Wallets integrated with marketing and CRM tools

Wallets integrated with marketing and CRM tools, such as Brevo CW, Splio, or Actito, are often rigid in their structure. These solutions are primarily designed to manage loyalty cards or promotional offers, with limited functionality tied to their ecosystem. They typically lack seamless integration with POS or ticketing systems, which can limit their adaptability.

Wallets integrated with POS and ticketing solutions

Wallets integrated into POS and ticketing solutions, such as Square or Weezevent, provide very limited functionality. They are often restricted to a single type of asset (e.g., Square only supports Apple Wallet cards and does not allow card transfers when switching POS systems).

Expert wallet solutions

Expert Wallet solutions, such as The Wallet Crew, offer advanced flexibility in administration and customization. They allow businesses to aggregate data from multiple systems (POS, CRM, ticketing, marketing) and enhance the user experience. By leveraging dynamic content, they integrate images, metadata, location-based information, artists, or playlists linked to an event, creating a richer engagement experience.

Key questions to consider before launching a mobile wallet project

Before implementing a Mobile Wallet, it is essential to assess your existing customer journey and expectations. This evaluation helps define the technical and functional prerequisites required for a smooth transition and successful adoption.

Assessing the customer journey and pain points

👉 What existing support methods are in place?

Does the customer currently use a physical card, a mobile app, an email with a barcode, or a PDF to manage loyalty cards, tickets, or memberships? Are these supports effective? Where are the pain points for users? (e.g., forgetting the card, difficulty accessing it, checkout delays, etc.)

👉 How do customers interact with their card or ticket?

- Where and how do customers use their cards or tickets? In-store, online, at access points, with customer service?

- 80% of retail traffic still occurs in-store—how can access be simplified at physical locations? (e.g., NFC scanners, self-service kiosks, checkout integration).

👉 What are the key objectives of implementing a Mobile Wallet?

- Reduce friction at checkout or when scanning for event entry.

- Lower costs associated with printing cards, tickets, and logistics.

- Boost customer engagement through real-time updates and push notifications.

Technical prerequisites: ensuring system compatibility

👉 Can my Wallet system easily connect with my existing tools?

- Is it possible to integrate the Wallet with my CRM, POS, ticketing solution, ERP, or marketing tools (e.g., Klaviyo, Bloomreach, Salesforce Marketing Cloud)?

- Are existing scanners, kiosks, or NFC readers compatible with a Mobile Wallet?

👉 Automating Updates: What data needs to be synchronized in real time?

- Should loyalty balances, tickets, memberships, or gift cards update automatically after use?

- Is it necessary to prevent fraud by updating a ticket after it is scanned at entry or a gift card after checkout?

👉 Ease of Card Configuration and Customization.

- Can I easily manage previews and set conditional rules? (e.g., a different color for student tickets requiring ID verification).

- Can I customize cards with images, dynamic QR codes, links, or animations?

Mobile wallet vs. dedicated app: which one do you need?

👉 Is a Mobile Wallet sufficient, or do I need an additional app?

- A Mobile Wallet provides instant access to a card or ticket without requiring an app download.

- A dedicated app allows for more complex interactions but requires strong user adoption and additional downloads.

👉 If the customer already has an app, how should the transition be managed?

- If an app already integrates cards or tickets, the Wallet should be added as a complement to avoid duplicating user journeys.

Encouraging Wallet adoption for customers accustomed to physical supports:

- Implement an educational campaign (via email, in-store displays, QR codes at checkout).

- Provide an exclusive incentive (e.g., bonus loyalty points for Wallet users).

Anticipating the evolution of mobile wallets and staying up-to-date with new features

Mobile Wallet functionalities evolve rapidly. A Wallet project should not be static, and it is essential to choose a solution that quickly integrates new features to stay competitive.

Does my Wallet provider keep up with Apple and Google updates? Apple and Google constantly enhance their Wallets with new features, including ticketing formats, promotional offers, and improved device compatibility.

The Wallet Crew was the first to implement:

- Offer management in Google Wallet, allowing brands to distribute targeted promotions directly into users’ Wallets.

- Apple Wallet’s new event ticketing formats, providing a richer and more interactive experience for attendees.

By choosing an expert solution like The Wallet Crew, you benefit from immediate access to the latest innovations, without waiting for costly internal development.

Why choose The Wallet Crew for your wallet project?

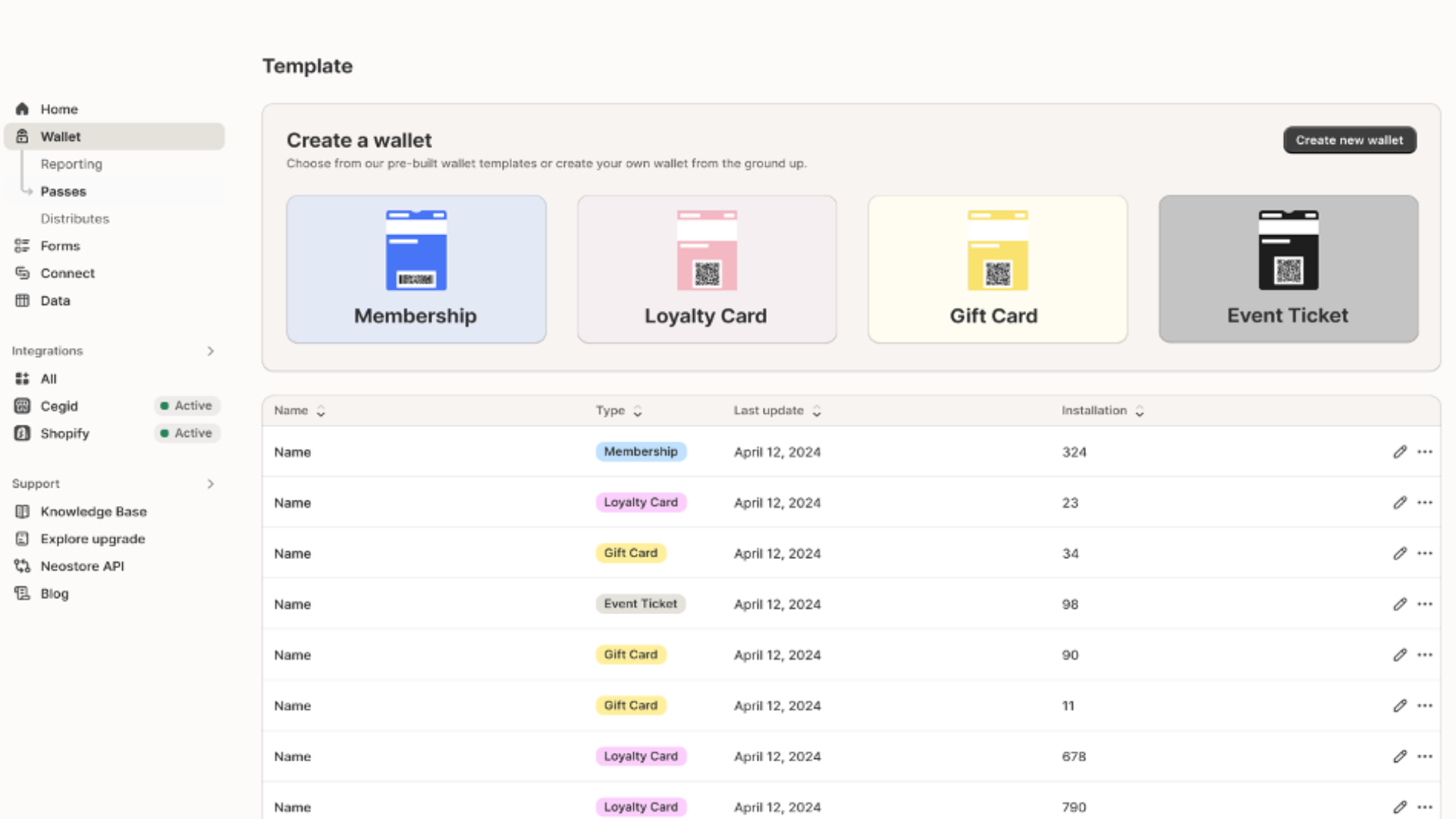

With The Wallet Crew, you have the freedom to manage and customize your Wallet cards autonomously, without relying on an external provider. Its seamless connectivity with POS, ticketing, and marketing tools allows you to integrate the Wallet into your existing ecosystem, ensuring centralized and efficient management.

Automating updates prevents unnecessary workload and eliminates duplicate marketing scenarios, saving valuable time.

The Wallet Crew intuitive interface offers advanced card configuration with dynamic conditions and real-time previews, making customization easy.

Always at the forefront of innovation, The Wallet Crew ensures you benefit from the latest Mobile Wallet advancements as soon as they are released.

Ready to Launch Your Wallet Project and Boost Customer Engagement? Contact us today to get started.