In a constantly evolving industry, mobile wallets present themselves as an innovative solution to optimize the participant experience while simplifying event management for organizers.

From multi-pass solutions to ticket personalization, simplified distribution, and geolocated notifications, discover how to create a memorable and seamless experience with mobile wallets!

Event: What can be digitized in a wallet?

During an event, many elements can be digitized and integrated into a mobile wallet. These include:

- Subscriptions,

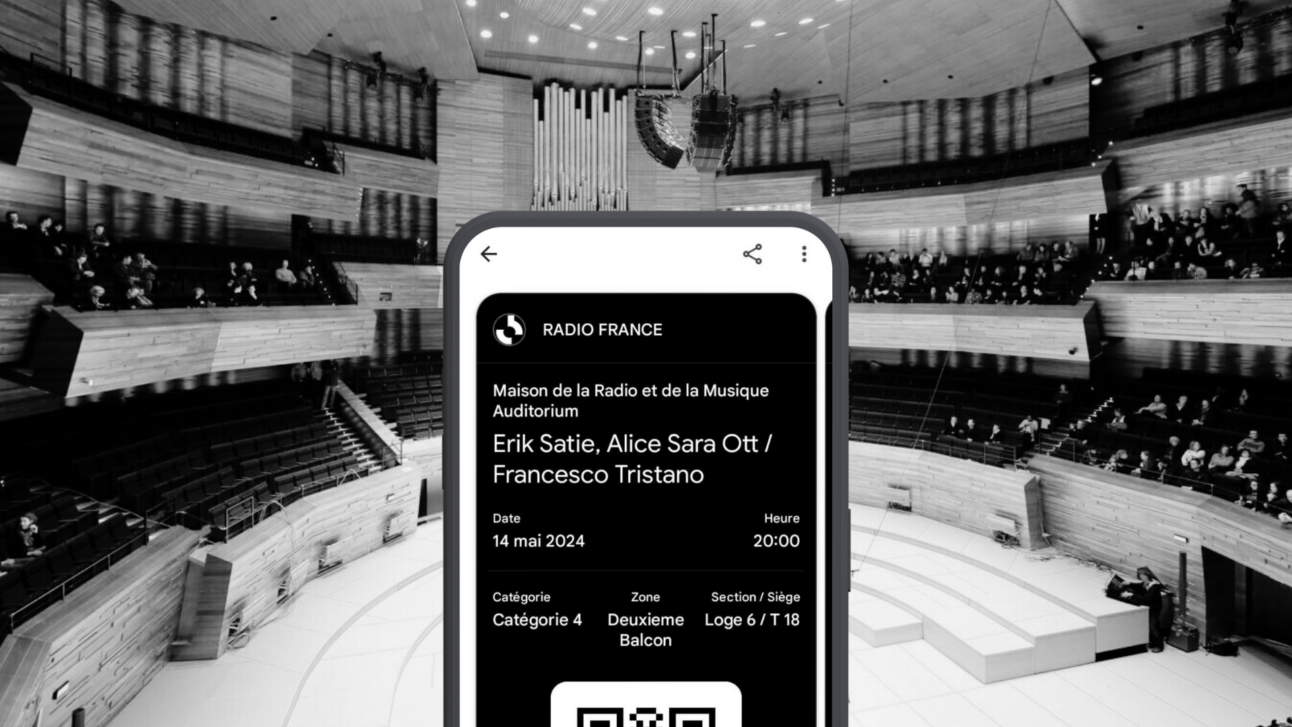

- Tickets,

- Parking access,

- And more.

👉 The goal is to centralize all necessary information and services for participants into a single interface, accessible from their smartphones, ensuring a seamless experience before, during, and after the event.

The Multiplicity of Access in Event Management

Event management is characterized by a diversity of passes and access types, often managed by distinct passes.

For example, during an event in a football stadium, each type of access typically requires a specific pass: one for parking, another for stadium seating, a third for food services, and others for areas like the club museum or official store.

This multiplicity of passes can quickly become cumbersome for participants to manage. This is where the idea of a multi-pass comes into play, which consolidates all these access points into a single digitalized support.

Accessible through a mobile wallet, the multi-pass not only simplifies access management for participants but also centralizes information and offers a more personalized and fluid experience.

Real-World Example: SNCF’s Multi-Pass

A concrete example of the effectiveness of a multi-pass is SNCF’s Pass Grand Voyageur. This unique pass allows users to consolidate various train tickets into a single pass. Whether for a TGV, a TER, or even access to specific services, everything is centralized in one support.

Translating this idea into event management means offering participants a similar solution: a unique pass integrated into their mobile wallet, giving them access to all services and areas of the event, such as parking, seating, food services, or even VIP zones.

This multi-pass would not only simplify participant logistics but also enhance their experience by eliminating the hassle of managing multiple physical or digital passes.

What’s New in Wallets: Apple and Google Wallet

With the release of iOS 18, Apple Wallet introduced a series of new features that enhance the user experience and facilitate event management. Key improvements include:

- Redesigned ticket interface,

- Seating plan visualization,

- Parking details,

- Practical services (food services, etc.),

- Local weather forecasts.

On the Google Wallet side, new features were announced at Google I/O 2024:

- Autolink Passes: Google Wallet can now automatically detect complementary passes and suggest adding them. For example, when adding a concert ticket, Google Wallet can suggest linking a discount coupon or a parking spot, providing a more cohesive and fluid user experience.

- Enhanced Push Notifications: Whenever a change is made to a pass already stored in Google Wallet, a push notification is automatically sent to inform the user of the updates. This ensures users always have the most up-to-date information about their passes, avoiding confusion during the event.

The Benefits of Using Wallets in Event Management

The use of mobile wallets in the event industry offers numerous advantages that help improve the participant experience while optimizing event management for organizers.

Security and Convenience

Mobile wallets allow participants to store their tickets securely directly on their smartphones. No more lost or damaged paper tickets: thanks to digitization, tickets are always accessible, even without an internet connection.

👉 At the entrance, participants simply present their digital tickets for quick access to the event.

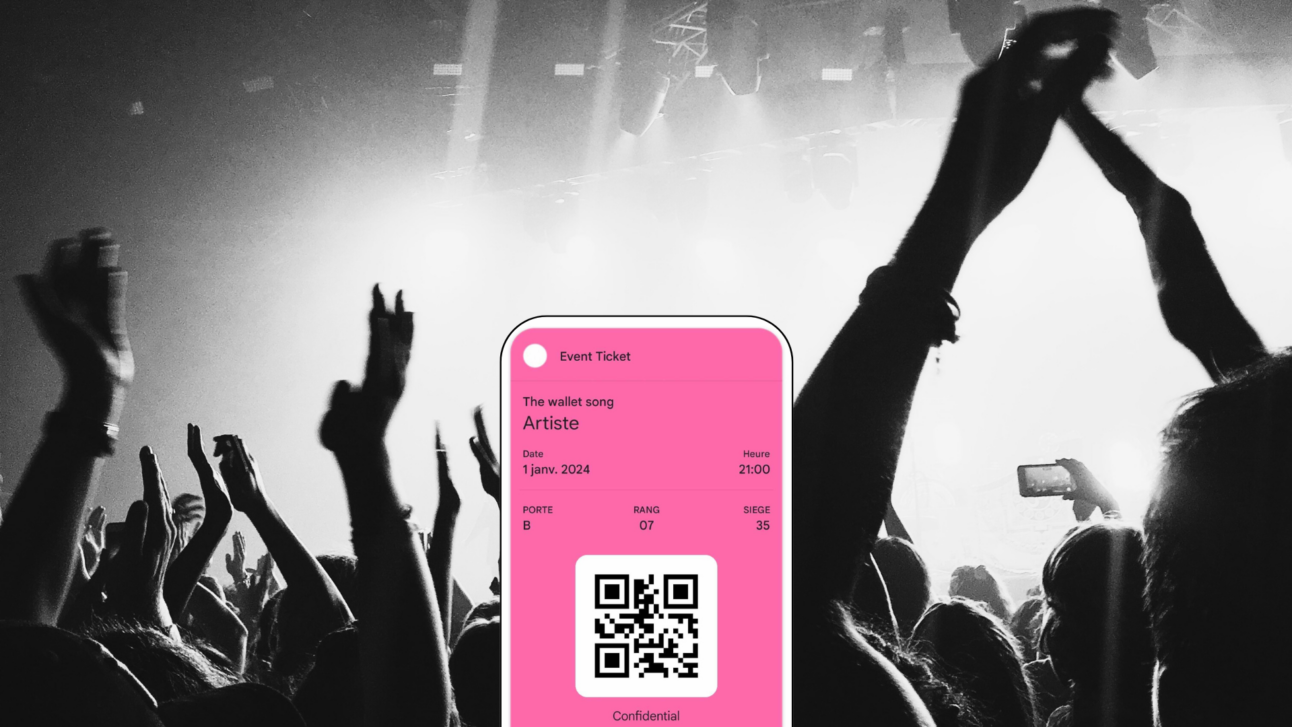

Ticket Personalization

Mobile wallets also offer the ability to personalize tickets according to the specific needs of the event.

For example, tickets can be differentiated by color or specific visual indicators for particular categories of participants. A ticket for a minor could have a distinct color, making it easier for event staff to verify the person’s identity and ensure they meet the access conditions.

In this way, personalization not only enhances security but also improves the user experience by speeding up checks and making them more precise.

Notifications Before, During, and After the Event

Another advantage of mobile wallets is the ability to send notifications to participants at key moments during the event:

- Before the event: Reminders can be sent to ensure participants don’t forget their tickets or to provide useful information about the day’s schedule.

- During the event: Real-time notifications can inform participants of program changes, on-site opportunities, or last-minute recommendations.

- After the event: Organizers can use these notifications to thank participants, provide information about future events, or gather feedback.

How to Integrate Wallets into These Events

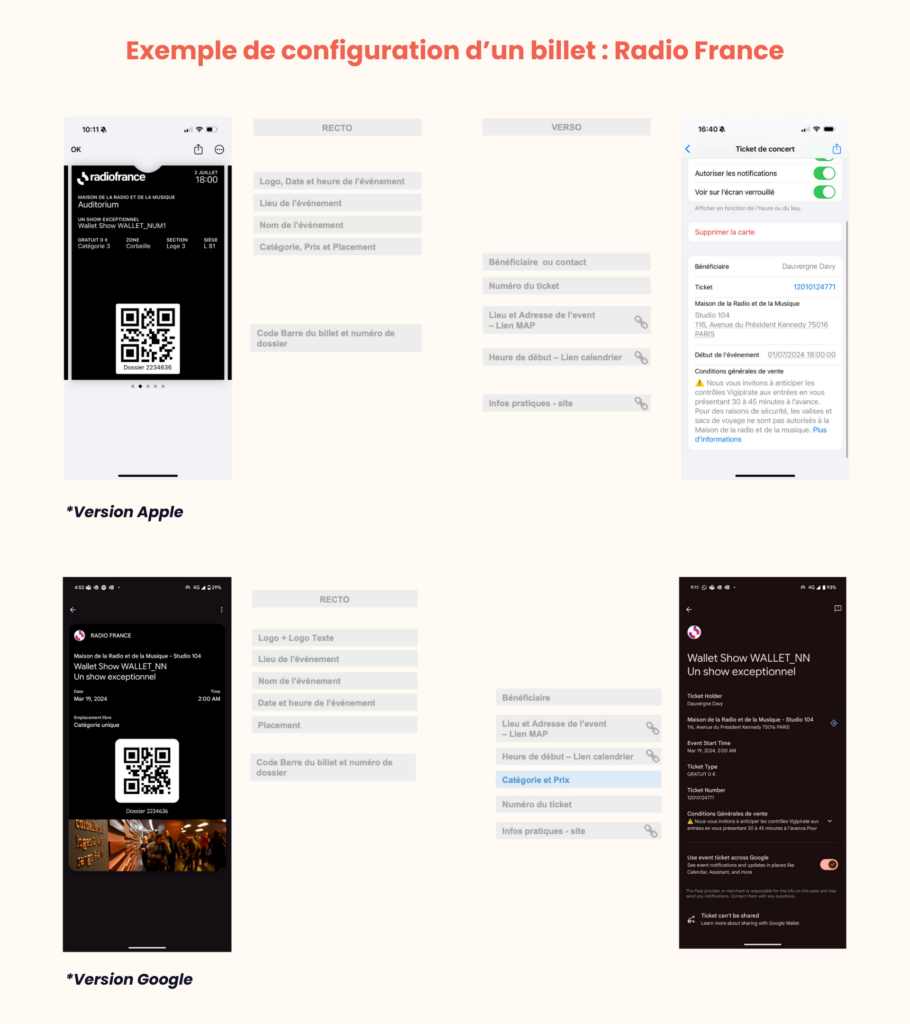

Wallet Configuration and Design

Apple and Google have each developed their own event ticket templates. If you want to delve into the specifics of each version, you can consult the detailed documentation available on the official sites:

For further customization, the Neostore interface allows you to configure your event tickets to match your brand. This means you can integrate your logo, choose colors, and add images.

You also have the option to customize essential elements such as the header and barcode. Finally, the back of the pass is fully customizable. This section is particularly important as it can include several essential elements, such as:

- Personalized offers and messages,

- Useful links such as the event location, a link to modify or transfer the ticket, or access to terms and conditions,

- Safety guidelines.

Ticket Distribution in Wallets

Participants can easily add their tickets to their mobile wallets in one click from various communication channels, including:

- Email and SMS,

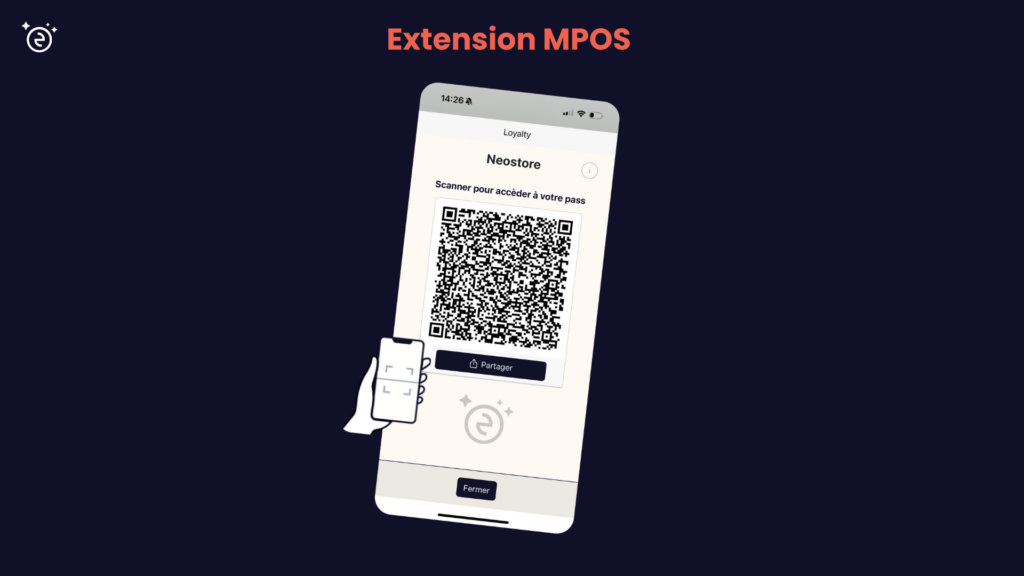

- QR code,

- Website (SDK),

- Mobile apps.

It is also possible to distribute and communicate access to wallet passes via physical points of sale by scanning a QR code or receiving a link via SMS/email.

Pass Identification at the Event via QR Code and NFC

Upon arrival at the event venue, participants can quickly identify themselves by using their digital pass via QR code or NFC technology.

For added convenience, participants will receive a geolocated notification when they are about 300 meters from the event venue. This notification automatically pre-opens the ticket on their phone, eliminating the need to search for their ticket in emails or apps.

Thus, participants only need to present their unique code or activate NFC to be identified at the entrance.

Conclusion

The integration of mobile wallets in event management offers significant advantages for both participants and organizers. By consolidating all access points into a single digital support, mobile wallets simplify event access and management.

The multi-pass approach, which centralizes various access types, perfectly illustrates the potential of these tools to enhance the user experience. Furthermore, the recent developments in Apple Wallet and Google Wallet further strengthen this trend.

In summary, mobile wallets offer customization possibilities that allow organizers to create unique experiences while ensuring proactive communication with participants throughout the event.